The Complete 2024 Guide to ABSD Exemption for Foreign Buyers in Singapore

By Patrik Tam | CEA Reg No: R0172720

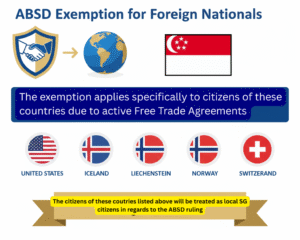

Purchasing property in Singapore is an exciting venture, but for a foreign buyer, the Additional Buyer’s Stamp Duty (ABSD) can feel like a significant barrier. The good news is that you may be eligible for an ABSD Exemption. Under Singapore’s Free Trade Agreements (FTAs), nationals of several countries are exempt from this charge.

Navigating the ABSD exemption process can be complex, but you don’t have to do it alone. As part of my comprehensive <a href=”https://getrealwithpat.com/services/”>Singapore property services</a>, I guide foreign buyers through every step of their purchase journey.

Who is Exempt from ABSD?

The exemption applies specifically to citizens of these countries due to active Free Trade Agreements:

· United States Citizens

· Citizens of Iceland, Liechtenstein, Norway, and Switzerland

The exemption applies to specific countries due to active Free Trade Agreements. However, it is crucial to note that Singapore Permanent Residents, while paying a different, lower ABSD rate, are not exempt.

Understanding the Eligibility Criteria

The Step-by-Step Process to Claim Your Exemption

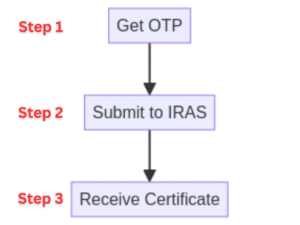

Claiming your exemption involves a specific process with the Inland Revenue Authority of Singapore (IRAS):

Submit the Application: Your lawyer will typically help you submit the necessary application form to IRAS, along with supporting documents like your passport copy.

Secure an Option to Purchase (OTP): This is the standard first step in buying any property in Singapore.

Receive Approval: Once approved, you will receive your stamp duty certificate, confirming the ABSD does not apply.

For the most current rates and detailed application procedures, always refer to the <a href=”https://www.iras.gov.sg/taxes/stamp-duty/for-property” target=”_blank” rel=”noopener”>Inland Revenue Authority of Singapore (IRAS) official guide on ABSD relief</a>.

Frequently Asked Questions About ABSD Exemption

- Q: Is a US Permanent Resident (Green Card holder) exempt from ABSD?

- A: No, the exemption applies only to US Citizens. Permanent Residents are not covered by the US-Singapore Free Trade Agreement (USSFTA) for ABSD purposes.

- Q: Do I need to apply for the ABSD exemption before I find a property?

- A: No, you typically secure an Option to Purchase (OTP) first, then your lawyer will submit the exemption application to IRAS along with the stamp duty paperwork.

- Q: If I am exempt from ABSD, am I also exempt from the Buyer’s Stamp Duty (BSD)?

- A: No. The exemption only applies to the Additional Buyer’s Stamp Duty (ABSD). The standard Buyer’s Stamp Duty still applies to all purchases.

Checklist of Documents for Your ABSD Exemption Application

- A copy of your valid passport

- The Option to Purchase (OTP) agreement

- IRAS application form (your lawyer will help with this)

- Any other supporting documents your lawyer advises

Why This Exemption Matters for Your Investment

Securing the ABSD exemption is not just about saving money upfront. It significantly improves your investment’s potential return and makes entering the Singapore property market a much more viable and attractive opportunity.

For a foreign buyer, the current ABSD rate is a staggering 60% on any residential property purchase.

Let’s calculate the savings for a S$2 million condo:

- Buyer WITHOUT Exemption (e.g., a Chinese national):

- Property Price: S$2,000,000

- ABSD Payable (60%): S$1,200,000

- Total Cost: S$3,200,000

- Eligible Buyer WITH Exemption (e.g., a US Citizen):

- Property Price: S$2,000,000

- ABSD Payable: S$0

- Total Cost: S$2,000,000

The Result: By being eligible for the ABSD exemption, you save S$1,200,000.

That’s not just a saving; it’s the entire price of another high-end property. This exemption is the key that unlocks the Singapore property market, turning an impossible investment into a achievable one.